All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money value of an IUL are usually tax-free up to the amount of premiums paid. Any type of withdrawals above this amount might be subject to taxes depending on policy structure.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for a minimum of 5 years and the person is over 59. Assets withdrawn from a typical or Roth 401(k) prior to age 59 might sustain a 10% charge. Not exactly The cases that IULs can be your very own bank are an oversimplification and can be misguiding for numerous factors.

Nonetheless, you might go through upgrading connected health and wellness concerns that can affect your ongoing expenses. With a 401(k), the cash is constantly your own, including vested employer matching despite whether you give up contributing. Danger and Guarantees: Firstly, IUL policies, and the cash value, are not FDIC guaranteed like conventional savings account.

While there is usually a flooring to stop losses, the growth capacity is topped (suggesting you might not totally gain from market growths). A lot of specialists will certainly agree that these are not equivalent products. If you desire survivor benefit for your survivor and are worried your retirement cost savings will certainly not be enough, then you might intend to consider an IUL or various other life insurance policy item.

Certain, the IUL can provide accessibility to a cash money account, yet again this is not the main purpose of the product. Whether you desire or need an IUL is a very specific question and relies on your key monetary purpose and goals. Below we will try to cover benefits and constraints for an IUL and a 401(k), so you can additionally delineate these items and make a more informed choice relating to the best way to manage retired life and taking care of your liked ones after fatality.

Indexed Universal Life With Living Benefits

Finance Costs: Lendings versus the plan accrue rate of interest and, if not paid off, minimize the survivor benefit that is paid to the recipient. Market Participation Limits: For the majority of policies, investment growth is connected to a supply market index, however gains are generally covered, restricting upside potential - best indexed universal life insurance policies. Sales Practices: These plans are typically marketed by insurance policy representatives that might highlight advantages without fully describing prices and threats

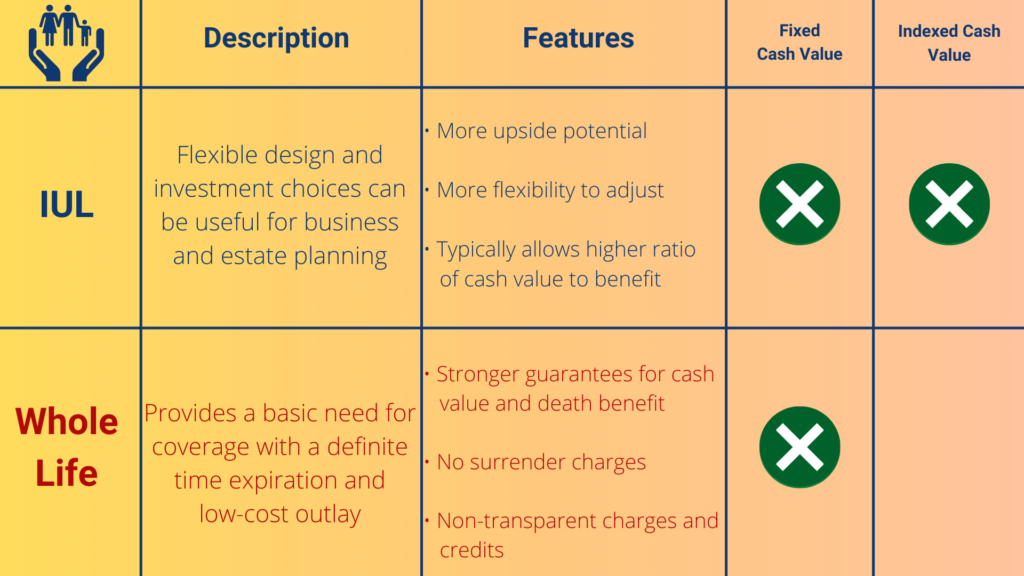

While some social media pundits recommend an IUL is a replacement item for a 401(k), it is not. Indexed Universal Life (IUL) is a type of permanent life insurance plan that also supplies a cash money worth component.

Latest Posts

Indexed Universal Life Insurance Reddit

Index Universal Life Insurance Fidelity

National Life Iul